Gross up formula

1 Total Taxes Net Percent. Divide the net payment by the.

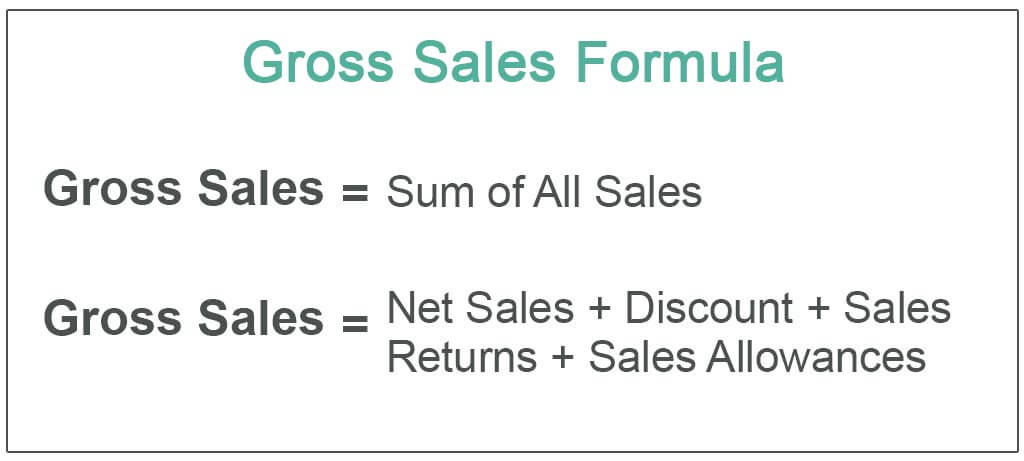

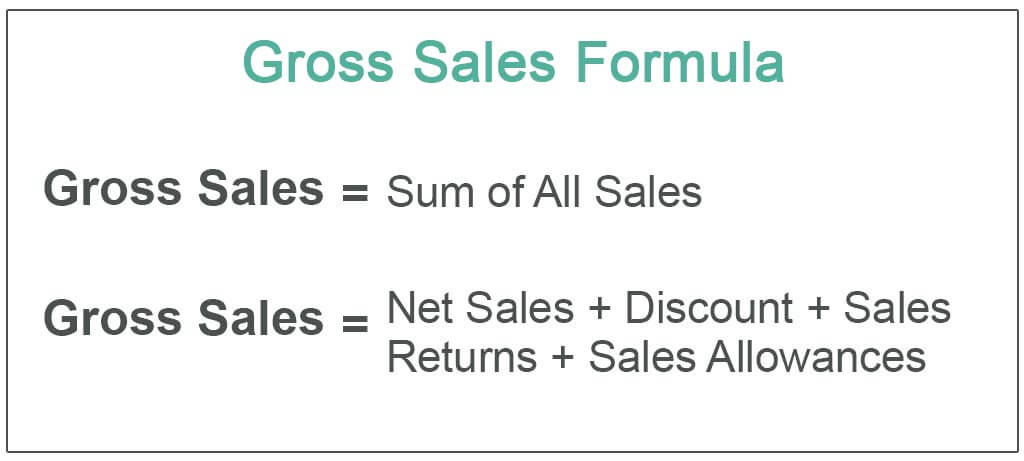

Gross Sales Formula Step By Step Calculation With Examples

A gross-up clause is one that makes it clear that A has to pay such further sum as after deducting any tax leaves B with 100.

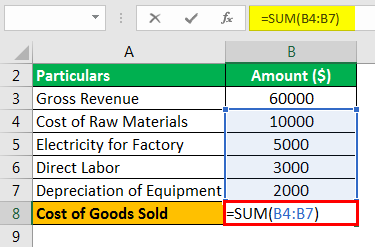

. For example an employer may gross. Gross-up pay works by dividing the employees wages by the net percentage of taxes that would be due. Cant use the normal grossing up formula of 1 Adding up all federal state and local tax rates 2 Subtract the total tax rates from 100 3 Divide net payments by the net.

Calculate it here with a free printable report. How to Gross-Up a Payment. Subtract the total tax percentage from 100 percent to get the net.

Use this federal gross pay calculator to gross up wages based on net pay. The formula for grossing up is as follows. Divide the net wages by the net percentage.

What is the gross-up formula. Subtract the above sum from the number one 1 tax net percentage3. Youll just need to know a few things including your net pay.

Need to know your gross wages. EXAMPLE Net interest is 100 and the tax rate is. Grossed-Up 338 h 10 Adjustments has the meaning specified in Section 412 d iv.

Vamos mostrar a seguir duas delas uma simplificada e outra mais. As a result Janes gross. On the IRS Form 1042-S issued to the student the full amount of 116279 will be reported.

Department pays Gross Up Amount. This will give you the net percent. If you want to experiment with our gross-up calculator you can calculate gross pay based upon take-home.

Or Select a state. The total equals the gross-up pay amount. Gross pay net pay 1 tax rate How do you calculate gross-up net.

Then take the total tax rate as a decimal and subtract it from 1. Formula 1 The Flat Method The flat method uses a flat percentage calculated on the taxable expenses and then added to the income. This is an estimated amount that the department needs to pay that will.

If the withholding tax rate is 10 the grossing up formula is. Determine total tax rate by adding the federal and state tax percentages. Use the Excelforce Services Gross Up Calculator to calculate the gross amount an employee must use for payroll taxes and how much they can take home.

O cálculo do Gross Up pode ser encontrado de diferentes maneiras. Gross-Up Formula has the meaning specified in Section 412 d iv. Add up all state and federal tax rates and if applicable local taxes2.

To remedy the situation you can gross up Janes bonus check. GROSS AMOUNT Net amount divided by 1-grossing-up rate A common example is grossing up interest for income tax or withholding tax. Stipend amount 10 tax rate Total stipend payment 10 - 14 tax.

Affordable Up to 50 less than a traditional payroll service. You work backward to come up with the gross-to-net pay calculation and divide 5000 by 75. Como calcular o Gross Up.

For example if an employee receives 500 in take-home pay this calculator can be used to.

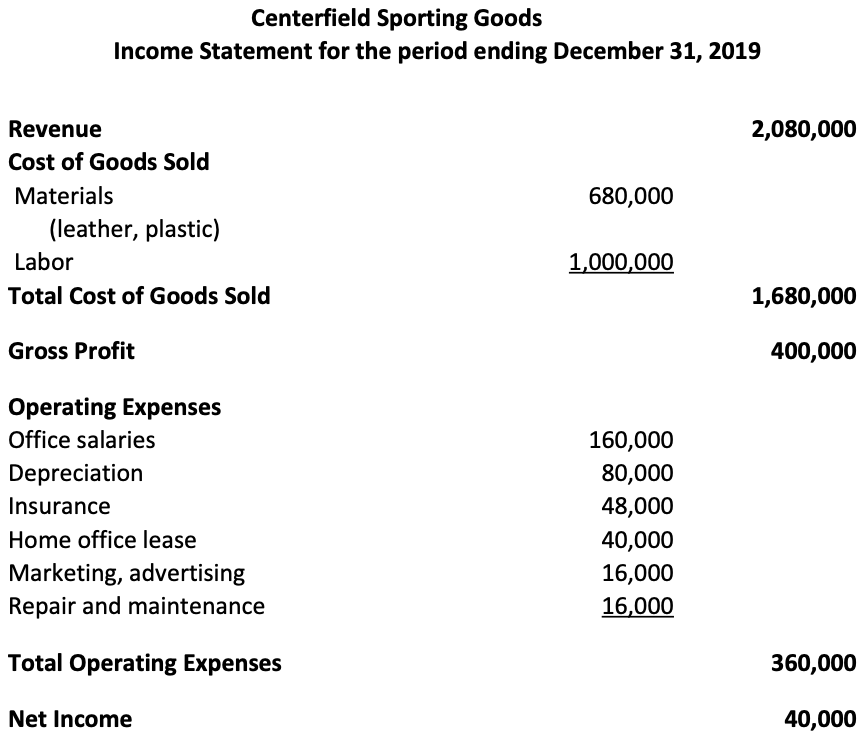

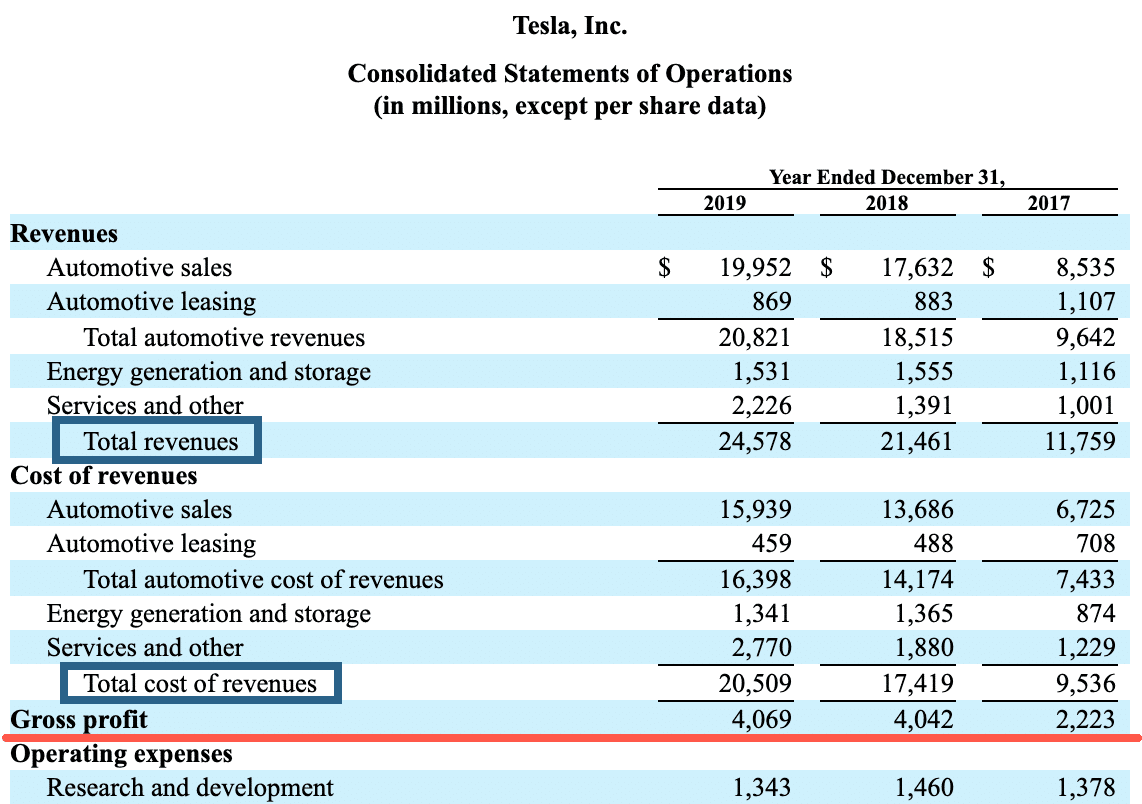

What Is Gross Margin And How To Calculate It Article

Gross Profit Margin Formula And Calculator Excel Template

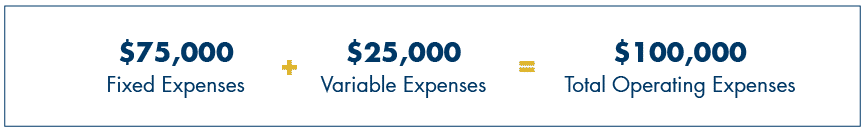

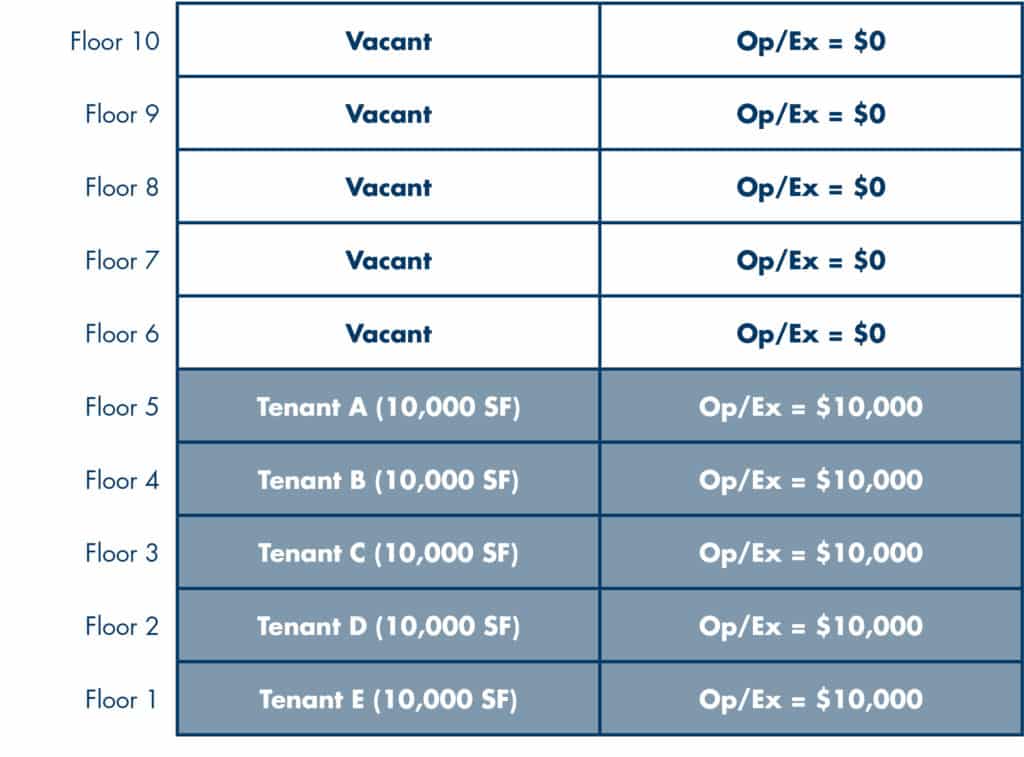

What Is An Operating Expense Gross Up Provision In A Lease

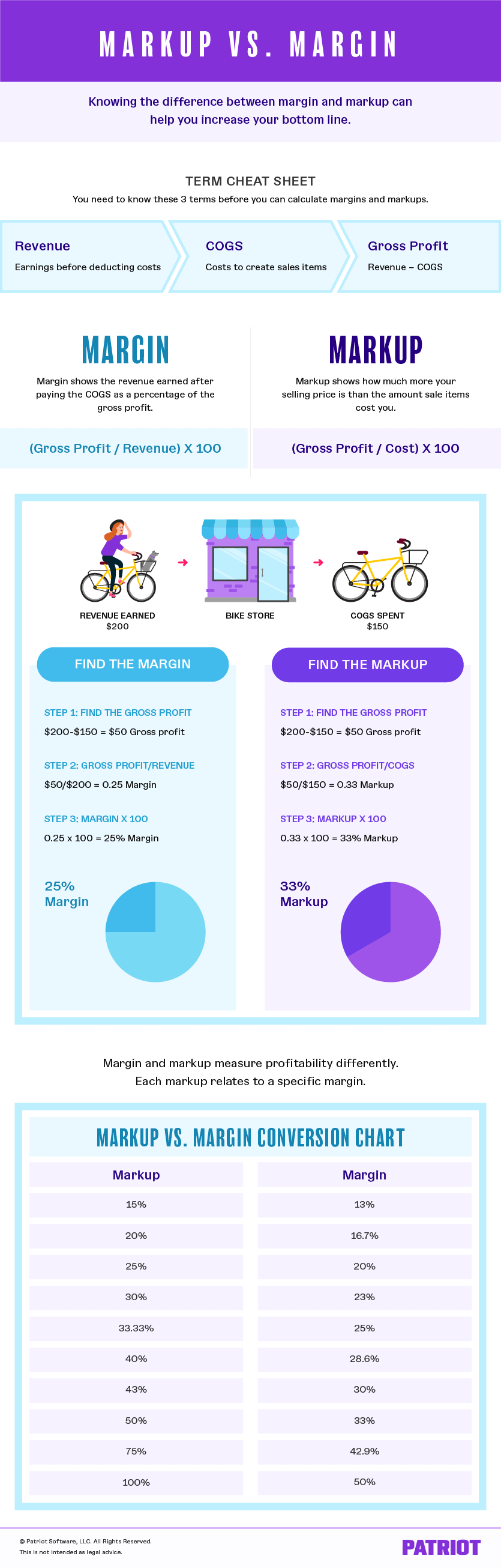

Margin Vs Markup Chart Infographic Calculations Beyond

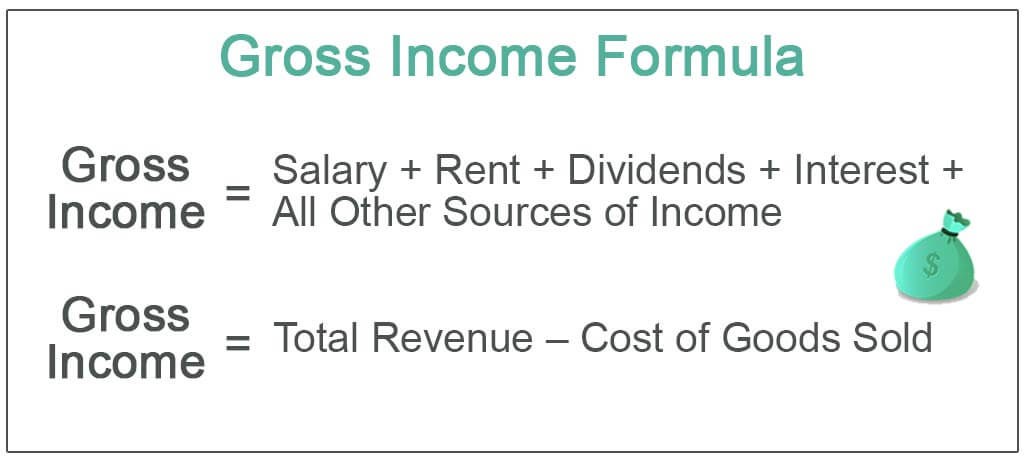

Gross Income Formula Step By Step Calculations

:max_bytes(150000):strip_icc()/GrossProfit-5c7ce1fdc9e77c00012f8248.jpg)

Gross Profit Vs Net Income What S The Difference

What Is An Operating Expense Gross Up Provision In A Lease

What Is Gross Up Tax Gross Up Formula Definition Caprelo

Gross Income Formula Step By Step Calculations

The Gross Profit Formula Lower Costs Raise Revenue Quickbooks Australia

Gross Sales Formula Step By Step Calculation With Examples

Net To Gross Calculator

What Is Gross Up Tax Gross Up Formula Definition Caprelo

How To Calculate Net Pay Step By Step Example

What Is Gross Profit Definition Formula And Calculation Stock Analysis

Gross Income Formula Step By Step Calculations

How To Calculate Gross Income Per Month